Best Travel Cards in India: Complete Comparison

Explore the best travel cards in India for 2025, comparing fees, benefits, and perks to make your international trips easier and more affordable.

Looking for the best travel cards in India for 2025? Here’s a quick guide to help you choose the right one for your international trips. Travel cards offer lower forex charges, real-time spending alerts, and added perks like travel insurance and lounge access.

Whether you’re a frequent flyer, a student studying abroad, or a leisure traveller, these cards can save you money and make your travel experience smoother.

Key highlights

- Niyo Card: Zero forex markup* on international transactions, no annual fees, complimentary spend-based lounge access abroad, and perks like free international ATM withdrawal#. Ideal for cost-conscious travellers.

- Axis Atlas Credit Card: Rewards on partner spends, lounge access, and travel insurance. Great for balanced benefits.

- HDFC Infinia Credit Card: High-end perks like unlimited lounge access, concierge services, and premium rewards. Perfect for luxury seekers.

- ICICI Emeralde Private Metal Credit Card: Exclusive benefits for high spenders, including unlimited lounge access and premium lifestyle perks.

- HSBC TravelOne Credit Card: Instant rewards and 1:1 points-to-miles conversion. Best for frequent travellers who value loyalty programme flexibility.

- Axis Bank Vistara Signature Card: Airline-specific benefits like Vistara points, priority check-in, and milestone rewards. Ideal for Vistara flyers.

Quick Comparison

| Card | Forex Markup | Annual Fee | Lounge Access | Best For |

|---|---|---|---|---|

| Niyo Card | 0% | ₹0 | Free lounge access abroad# | Budget travellers, students |

| Axis Atlas Credit Card | 3.5% | ₹5,000 +GST | Multiple lounges | Balanced perks and rewards |

| HDFC Infinia Credit Card | 0% | ₹12,500 +GST | Unlimited (Global) | Luxury and high spenders |

| ICICI Emeralde Metal Card | 2% +GST | ₹12,499 +GST | Unlimited (Global) | Premium lifestyle and exclusivity |

| HSBC TravelOne Credit Card | 3.5% +GST | ₹4,999 +GST | Domestic & International | Frequent flyers, loyalty rewards |

| Axis Vistara Signature Card | 3.5% +GST | ₹2,500 +GST | Limited (Domestic) | Vistara loyalists |

*VISA exchange rates apply | #T&C apply

Conclusion

Choose the Niyo Card for affordable international transactions or the HDFC Infinia Credit Card for premium experiences. Frequent Vistara flyers may find the Axis Vistara Signature Card rewarding, while the Axis Atlas Credit Card offers a good mix of benefits. Select a card based on your travel frequency, spending habits, and preference for perks.

Best travel credit cards in India - 2025 edition! Which one should you really get?

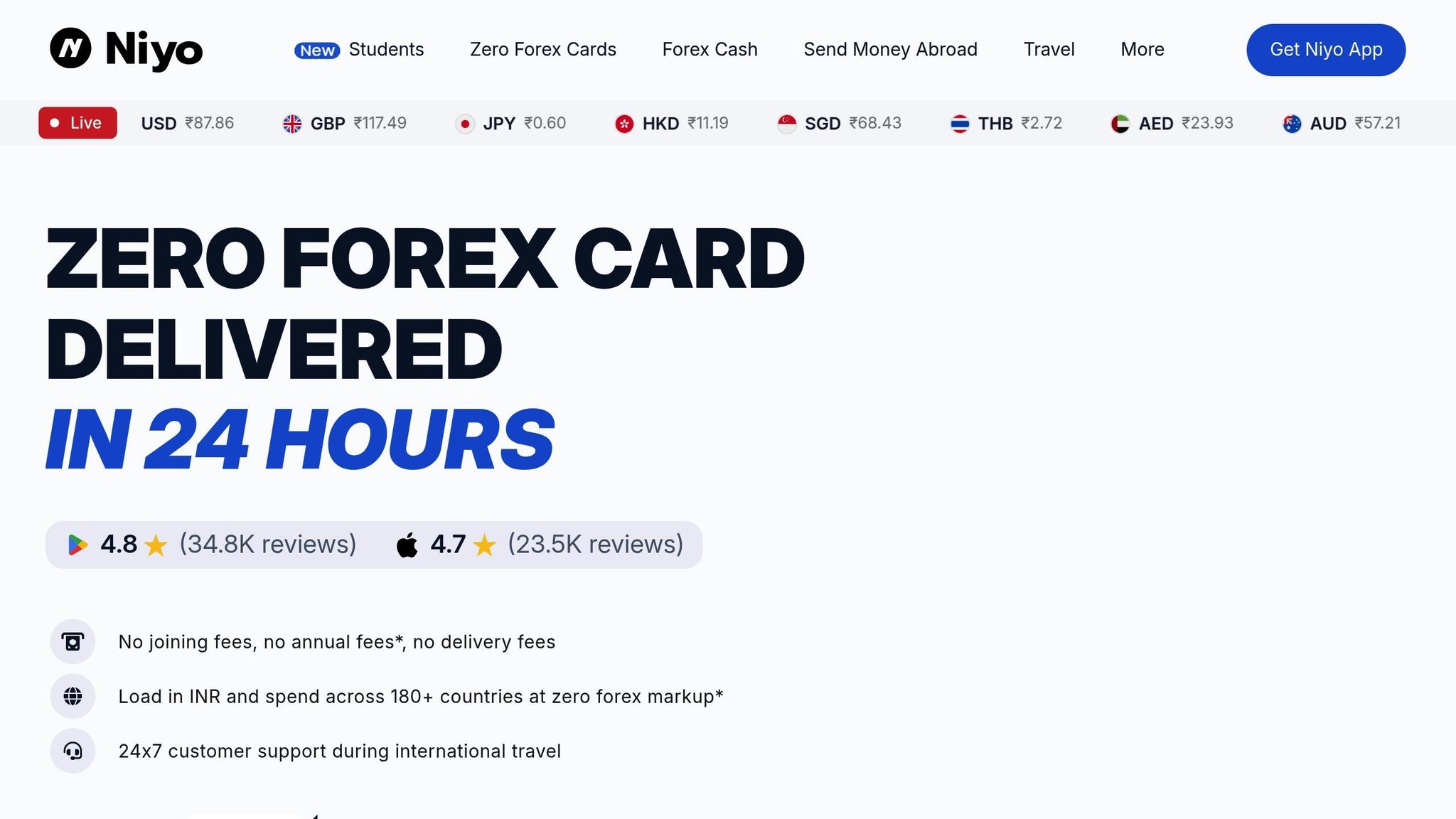

1. Niyo Card

Niyo cards are designed to make international spending simpler and cheaper by eliminating those frustrating transaction charges. The range includes the DCB Niyo Debit Card, Niyo SBM Credit Card, and Niyo SBM Debit Card, all crafted to make overseas expenses more manageable and budget-friendly.

What makes Niyo stand out is its commitment to solving common pain points faced by international travellers, especially those unexpected charges that show up after a trip. These cards are accepted in over 180 countries, and the app comes bundled with handy travel services like flight bookings, visa assistance, travel insurance, hotel bookings, foreign currency doorstep delivery, outward remittances, and even international eSIM services. Let’s dive into the specifics.

Forex markup rates

One of the biggest perks of Niyo cards is the zero forex markup on international transactions. Unlike traditional cards that typically charge up to 5% on such transactions, Niyo processes all payments at the exact VISA exchange rates.

For instance, if you spend ₹10,000 overseas, you’ll only pay ₹10,000, unlike conventional cards, where you’d be charged anywhere between ₹10,300 and ₹10,500. For frequent travellers, this could mean saving up to 5% on every international transaction.

This zero forex markup benefit isn’t limited to just in-person purchases abroad; it also applies to online transactions in foreign currencies, whether you’re shopping internationally or booking services from India.

Annual/Joining fees

Niyo travel cards come with no annual or joining fees, making them an attractive option for travellers across various budgets. This fee-free structure ensures that the savings from zero forex markup aren’t offset by hidden costs, making these cards a smart choice even for occasional international travellers.

Rewards and travel benefits

Niyo offers more than just savings on transactions. The Niyo ecosystem includes the Niyo Coins rewards programme, where you can redeem points for travel services.

The cards are backed by 24/7 in-app customer support tailored for international travellers, ensuring help is always at hand, no matter the time zone. Features like real-time alerts for expense tracking, a mobile app with surcharge-free ATM Locator, Currency Convertor tool for live forex rates, spend summaries, and transaction histories add convenience to your travels.

Additional travel services include international eSIM plans starting at ₹50, covering over 120 countries with high-speed 4G/5G connectivity. Visa services boast a 99.4% approval rate for tourist visas across 50+ countries, with a fully online application process. Customisable travel insurance plans cover essentials like medical emergencies, baggage loss, and trip cancellations.

For accommodation and flights, Niyo offers hotel bookings where up to 75% of the cost can be paid using Niyo Coins. Flight bookings come with zero convenience fees#, and you can even redeem Niyo Coins for discounts, making your travel planning more affordable.

2. Axis Atlas Credit Card

The Axis Atlas Credit Card is designed for those who frequently travel, offering a range of perks tailored to enhance your journey. From complimentary lounge access to earning travel points, this card makes every trip more rewarding. Plus, it offers competitive forex rates for international transactions, making cross-border payments smooth and cost-effective. To top it off, the card comes with travel insurance, offering peace of mind for globetrotters.

Some standout features include a well-structured fee system, favourable forex rates, access to airport lounges, and a robust rewards programme. For the most up-to-date details, it’s best to check Axis Bank’s official website.

Let’s now explore another premium travel credit card option that might catch your attention.

3. HDFC Infinia Credit Card

The HDFC Infinia Credit Card is a premium offering tailored for high-net-worth individuals who value luxury and convenience, especially when travelling. With its sleek metal design and an array of exclusive features, this card is perfect for those seeking a seamless and rewarding travel experience.

Forex markup rates

One of the standout features of the HDFC Infinia Credit Card is its zero forex markup on international transactions. Whether you’re shopping abroad or making online purchases in foreign currencies, you won’t incur the usual fees. To put this into perspective, if you spend ₹2,00,000 annually on international transactions, you could save around ₹6,000-8,000 compared to cards that typically charge a 3.5% forex markup.

Annual/Joining fees

The card comes with an annual fee of ₹12,500 (plus taxes). However, this fee is waived if your yearly spending exceeds ₹10,00,000. Additionally, HDFC Bank occasionally rolls out special promotions for new applicants, making it even more appealing.

Airport lounge access

With the HDFC Infinia Credit Card, you gain unlimited complimentary access to over 1,000 airport lounges worldwide via the Priority Pass programme. This includes both domestic and international lounges, and you can also bring along a guest at no extra cost. On top of that, cardholders can access HDFC Bank’s exclusive lounges in major Indian airports, ensuring a relaxing experience whether you’re on a domestic or international journey.

Rewards and travel benefits

The rewards programme on this card is unmatched. Cardholders earn 3.33% rewards on every spend, with no restrictions on categories or limits on how much you can earn. These reward points can be redeemed for flights, hotel stays, or even transferred to airline frequent flyer programmes at attractive conversion rates.

The card also comes with travel insurance coverage of up to ₹3 crore, which includes protection against medical emergencies, trip cancellations, and lost baggage.

For those looking for something extra, the card offers access to Infinia Experiences, which include specially curated travel packages and lifestyle events exclusive to cardholders. Additional perks include concierge services, golf privileges at top-tier courses, and dining benefits at premium restaurants in India and abroad.

4. ICICI Emeralde Private Metal Credit Card

The ICICI Emeralde Private Metal Credit Card is a high-end travel card, exclusively available by invitation to ICICI Bank’s high-net-worth clients. Introduced in late 2023, this premium metal card is tailored for affluent travellers who value luxury and exceptional rewards, especially during international trips.

Forex markup rates

When it comes to international transactions, the card applies a 2% forex markup, which, after GST, totals 2.36%. This translates to a net benefit of approximately 0.4–0.5% on overseas spending.

Annual and joining fees

The card comes with a joining fee and annual fee of ₹12,499 plus taxes. However, the annual fee is waived if you spend ₹10 lakh or more during the anniversary year of the card. To offset the joining fee, the welcome package includes 12,500 bonus reward points (worth up to ₹12,500), a one-year Taj Epicure Membership featuring a complimentary night’s stay, and an EazyDiner Prime Membership. For annual renewals, cardholders receive another 12,500 reward points and a renewed EazyDiner Prime Membership. Additionally, the card offers global lounge access to enhance your travel experience.

Airport lounge access

This card ensures unlimited complimentary access to domestic and international airport lounges worldwide. Both the primary cardholder and any add-on cardholders can enjoy this privilege, making it perfect for families or couples travelling together.

Rewards and travel benefits

The rewards programme is one of the card’s standout features. For every ₹200 spent on retail transactions, you earn 6 reward points, which can provide a 3% value back when redeemed for flights, hotels, or select premium vouchers.

An exciting addition is the iShop portal, launched in February 2025, which boosts rewards on travel bookings. Through this portal, you can earn up to 12X points on hotels (equivalent to a 36% value) and 6X points on flights (18% value), with a monthly cap of 18,000 points.

For those who hit spending milestones, an annual spend of ₹8 lakh earns EaseMyTrip vouchers worth ₹6,000. The card also offers extensive travel insurance, including ₹3 crore coverage for air travel accidents, along with protection for lost baggage, travel documents, and medical expenses incurred abroad.

Additional lifestyle perks include unlimited complimentary golf rounds, premium dining experiences, and zero cancellation charges on hotel, flight, and travel bookings for up to 2 transactions annually (capped at ₹12,000). High spenders can enjoy benefits valued at over ₹1.4 lakh annually.

For the best value, redeem reward points at a 1:1 ratio for flights, hotels, or premium vouchers. Avoid using points for statement credit, as this only offers a redemption value of ₹0.4 per point.

Zero forex markup cards and cash for your international travel

Get zero forex markup Niyo Card, seamless travel services, and smart tools for hassle-free global experiences. Trusted by over 1 million travellers.

Get Your Niyo Card5. HSBC TravelOne Credit Card

The HSBC TravelOne Credit Card stands out in the premium travel card segment, offering rewards designed to appeal to frequent travellers. With its focus on instant travel benefits, this card is perfect for those who value quick reward redemptions and access to a wide range of airline and hotel loyalty programmes.

Forex markup rates

One downside to consider is the forex markup fee of 3.5%, which increases to about 4.13% after GST. Compared to cards with lower forex fees, this might not be the best choice for those looking to minimise transaction costs. However, it remains a strong option for those who prioritise earning rewards over saving on fees.

Annual and joining fees

The card charges a joining fee and an annual fee of ₹4,999, plus 18% GST. For high spenders, there’s good news - the annual fee is waived if you spend ₹8 lakh or more in a year.

Airport lounge access

Cardholders can enjoy complimentary access to both domestic and international airport lounges, with no minimum spending requirements.

Rewards and travel benefits

The HSBC TravelOne Credit Card offers impressive rewards, including up to 12% value-back on travel expenses. Points can be converted at a 1:1 ratio into airline miles or hotel loyalty points. Travel bookings made through select platforms come with discounts of up to 15%, and the HSBC Rewards Marketplace provides additional earning opportunities. Golf enthusiasts will appreciate perks like complimentary rounds and green fee offers.

The card also shines with its flexible redemption process, allowing instant transfers to various airline and hotel loyalty programmes. These features have earned it high praise from industry reviewers.

The card has received a 4.5/5 rating from CardExpert and an overall 3.5/5 rating from Paisabazaar, with travel benefits scoring 4.0/5.

Limitations to consider

While the card offers many advantages, it does come with a few drawbacks. The exclusion list for earning reward points is longer compared to some competitors, and the approval process can be stringent. Additionally, the welcome benefits are tied to specific spending conditions, which may be a hurdle for new cardholders.

6. Axis Bank Vistara Signature Card

The Axis Bank Vistara Signature Card is a co-branded credit card tailored for frequent flyers who value premium travel perks and Vistara-specific benefits. With this card, Axis Bank and Vistara come together to offer travellers a chance to earn Club Vistara points while enjoying exclusive privileges. Here’s a closer look at its fees, rewards, and travel benefits.

Forex markup rates

For international transactions, the card charges a 3.5% forex markup fee, which amounts to around 4.13% when GST is added. While this rate isn’t the lowest in the market, the card makes up for it by offering a robust rewards programme and airline benefits that can help offset these costs for regular travellers.

Annual and joining fees

The card has a joining fee of ₹2,500 (plus taxes) and an annual fee of ₹2,500 (plus GST). This pricing strikes a balance between affordability and the premium travel benefits it offers, making it a practical choice for those who fly frequently.

Airport lounge access

Cardholders can enjoy complimentary domestic lounge access at over 700 lounges in India through the Mastercard network. The card includes 8 free visits per year to domestic lounges, while additional visits are charged at standard rates. For international travellers, lounge access is available at select partner lounges, subject to terms and conditions.

Rewards and travel benefits

The Axis Bank Vistara Signature Card truly shines with its rewards and travel perks:

- Earn 6 Club Vistara points for every ₹200 spent on Vistara flights, and 2 points for every ₹200 on other purchases.

- New cardholders are welcomed with 5,000 Club Vistara points and a complimentary flight voucher worth ₹4,000, provided they spend ₹1 lakh within the first 90 days.

- Additional perks include priority check-in, boarding privileges, milestone bonus points, travel insurance, and purchase protection.

Other notable benefits include:

- A fuel surcharge waiver of up to ₹500 per month on fuel transactions between ₹400 and ₹4,000.

- Milestone rewards, such as bonus Club Vistara points for meeting annual spending thresholds.

- Tier qualification benefits allow cardholders to climb the Club Vistara membership tiers faster by earning bonus tier points through their spending.

This card is designed to enhance the travel experience while providing meaningful rewards for frequent flyers, making it a strong option for those who value convenience and premium airline benefits.

Advantages and disadvantages

Selecting the right travel card for international trips involves weighing the pros and cons of each option. Different cards cater to different types of travellers, so understanding their features can help you make an informed choice. Here’s a breakdown of the key benefits and drawbacks of popular travel cards:

| Card | Key Advantages | Main Disadvantages |

|---|---|---|

| Niyo Card | Zero forex markup* Free lounge access abroad# Real-time spending alerts Free card Load in INR, spend in 180+ countries 1 free int’l ATM withdrawal per quarter# 24/7 customer support | Limited premium perks |

| Axis Atlas Credit Card | Generous rewards on partner transactions Comprehensive travel insurance Access to multiple airport lounges Attractive milestone benefits | Relatively high annual fee Forex markup fee applies Reward system may require strategic spending |

| HDFC Infinia Credit Card | Premium metal design and concierge services Extensive lounge access (domestic and international) High rewards returns Strong travel benefits | High annual fee Limited eligibility Forex markup fee applies |

| ICICI Emeralde Private Metal Credit Card | Ultra-premium benefits Unlimited lounge access Dedicated relationship manager Exclusive lifestyle privileges | Very high annual fee Limited accessibility Forex markup fee applies Invitation-only |

| HSBC TravelOne Credit Card | Competitive forex markup Good international acceptance Reasonable annual fee Decent travel insurance coverage | Limited lounge access Modest rewards Fewer premium perks than top-tier cards |

| Axis Bank Vistara Signature Card | Airline-specific benefits Earn club points on flights Priority boarding and check-in Reasonable annual fee | Forex markup fee applies Benefits limited to a single airline ecosystem Restricted complimentary lounge visits |

*VISA exchange rates apply | #T&C apply

This table highlights how these cards differ in terms of cost, usability, and premium features.

The Niyo Card stands out for its zero forex markup, making it a great choice for cost-conscious travellers. It also offers practical features like real-time spending alerts and round-the-clock customer support. Mid-tier cards, such as the Axis Atlas Credit Card, balance affordability with perks like lounge access and travel insurance, though they come with forex fees and higher annual charges. On the premium end, cards like the HDFC Infinia Credit Card and ICICI Emeralde Private Metal Credit Card justify their steep fees with exclusive benefits, including concierge services, unlimited lounge access, and lifestyle privileges.

Ultimately, the best travel card for you depends on how often you travel, your spending habits, and the value you place on premium perks. Whether you prioritise savings, convenience, or luxury, there’s a card tailored to your needs.

Conclusion

When choosing a travel card, it’s all about finding the one that fits your travel style, spending habits, and priorities. Different cards are tailored to meet the needs of various types of travellers.

If you’re a frequent traveller on a budget, the Niyo Card is worth considering. Its real-time spending alerts and round-the-clock customer support make it ideal for those focused on saving money rather than indulging in premium perks. This card is especially useful for students, young professionals, or anyone making regular international transactions without needing luxury benefits like lounge access.

For those seeking a balance between affordability and benefits, cards such as the Axis Atlas Credit Card or HSBC TravelOne Credit Card strike a good middle ground. These cards often come with reasonable annual fees and essential travel perks. The Axis Atlas card, for instance, is great for users who frequently shop with partner merchants and can take advantage of milestone rewards.

If luxury and exclusive privileges are your priorities, premium cards like the HDFC Infinia Credit Card or ICICI Emeralde Private Metal Credit Card offer unmatched benefits. With features like extensive lounge access, concierge services, and exclusive privileges, these cards cater to high-net-worth individuals who travel frequently. While their annual fees are on the higher side, the perks often justify the cost for those who value premium experiences.

For airline loyalty enthusiasts, the Axis Bank Vistara Signature Card is a strong contender. With perks like priority boarding and club points, it’s a great option for frequent flyers who prefer Vistara Airlines and want to maximise their travel rewards.

Ultimately, if you’re a regular international traveller, a premium card with comprehensive benefits might offer better value. On the other hand, occasional travellers can opt for cost-effective choices like the Niyo Travel Card, which keeps fees low while providing essential features.

The key is to pick a card that aligns with your financial goals and travel preferences. With these top travel cards in India, there’s an option to make international spending easier and your journeys more rewarding.

Frequently Asked Questions

When choosing a travel card in India, it’s all about finding one that saves you money and makes your trips hassle-free. Start by looking at forex markup charges and foreign transaction fees - lowering these costs can make a big difference, especially if you’re a frequent traveller.

You should also check the rewards programme, annual fees, and how widely the card is accepted at international merchant locations. Cards that offer perks like cashback, reward points, or lounge access can elevate your travel experience while helping you stay within budget. Most importantly, pick a card that’s simple to use and ensures smooth transactions abroad, so you can focus on enjoying your journey without added stress.

Foreign exchange (forex) markup fees are extra charges added to international transactions, usually ranging between 1% and 5% of the transaction amount. These fees can make your overseas spending more expensive than you might expect. Opting for a travel card with minimal or no forex markup fees can help you cut down on these additional costs, making international purchases much lighter on your wallet.

For those who travel often, cards with zero forex markup are particularly useful. They completely remove these extra charges, allowing you to get better value for every rupee you spend abroad. Always check the forex markup rates before picking a travel card to ensure you maximise your savings and enjoy hassle-free international spending.

Premium travel cards, such as the HDFC Infinia Credit Card, are tailored for frequent travellers who enjoy the finer things in life. These cards come packed with perks like unlimited airport lounge access, higher reward points on travel-related spending, and extras like travel insurance and milestone rewards. If you’re someone who prioritises luxury and exclusive benefits during your journeys, these cards are a perfect match.

In contrast, affordable travel cards like the Niyo Travel Card are all about keeping costs low while still offering useful features. With benefits such as zero forex markup, low fees, and basic rewards, these cards are ideal for occasional travellers or those who want to save more on their trips. Whether you travel often or just once in a while, these cards cater to different needs, letting you pick one that aligns with your budget and travel habits.