Complete Travel Insurance Guide for Indians

Understand the essentials of travel insurance for Indians, including types, coverage, and tips for seamless claims during your journeys.

Travel insurance is your financial safety net for unexpected travel disruptions. Whether you’re travelling within India or abroad, it can cover emergencies like medical issues, trip cancellations, or lost baggage. For international trips, it’s crucial due to high healthcare costs in countries like the UK or Australia, and some visa processes (like Schengen) even mandate it. Domestic travel insurance focuses on risks like delays or monsoon disruptions.

Here’s what you need to know:

- Types of Policies: Single-trip, multi-trip, student, family, senior citizen, and group insurance.

- Coverage: Medical expenses, trip cancellations, baggage loss, emergency evacuations, and personal liability.

- Exclusions: Pre-existing conditions (unless declared), high-risk activities, alcohol-related incidents, and travel to restricted regions.

- Choosing the Right Plan: Consider your destination, trip length, purpose, and budget. Opt for higher medical coverage for international trips and ensure your policy fits specific needs like adventure sports or pre-existing conditions.

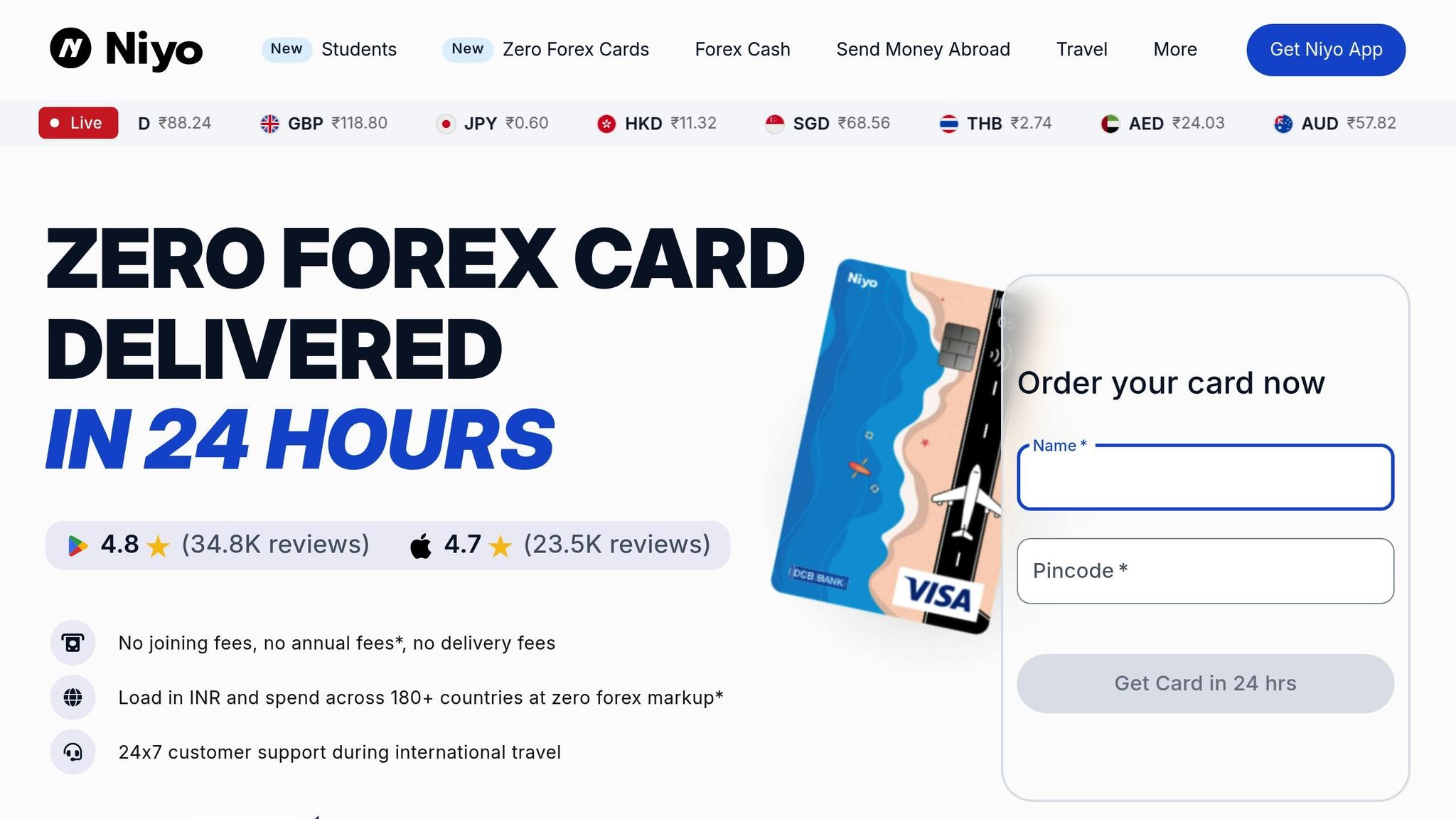

Niyo’s travel insurance integrates with their app, offering INR pricing, digital claims, and 24/7 support. It’s tailored for Indian travellers, covering medical emergencies, cancellations, and more, with added tools like zero forex cards and eSIMs.

Stay prepared: Keep documents handy, understand claim timelines, and ensure your policy matches your travel requirements. A little planning can save you from unexpected expenses.

Coverage Types and Policy Features

Choosing the right travel insurance policy means understanding the variety of options available and how they cater to different travel needs. Each type of policy is designed to address specific traveller profiles and destinations, helping shield you from unexpected financial setbacks during your journey.

Types of Travel Insurance Policies

- Single Trip Insurance: This is ideal for travellers planning one specific journey, covering you from the start of your trip until you return. Whether it’s a short holiday or an extended trip, this policy suits occasional travellers.

- Multi-Trip Insurance: Designed for frequent travellers, this policy offers year-round protection for multiple trips within 12 months. It sets individual coverage limits for each trip and is often a cost-effective choice for business professionals or families who travel frequently.

- Student Travel Insurance: Tailored for Indian students studying abroad, this policy often includes extended coverage periods, enhanced medical benefits, and features like coverage for study interruptions.

- Family Travel Insurance: This policy covers all family members under a single plan, including adults and dependent children. It’s a convenient and often economical option compared to purchasing separate policies for each individual.

- Senior Citizen Travel Insurance: Specifically designed for older travellers, these policies provide additional medical benefits, including coverage for pre-existing conditions, ensuring peace of mind for those above a certain age.

- Group Travel Insurance: Perfect for organised groups such as corporate teams or tour groups, this policy provides coverage for all members, tailored to suit collective travel needs.

These options allow travellers to choose coverage that aligns with their specific requirements, ensuring peace of mind during their journeys.

What’s Covered and What’s Not

Travel insurance policies typically include a range of protections, but it’s essential to know what’s included - and what isn’t.

- Medical Expenses Coverage: Most policies cover hospital bills, doctor consultations, prescription medicines, and emergency dental treatments. International policies often offer broader coverage compared to domestic ones.

- Trip Cancellation and Interruption: This feature reimburses non-refundable expenses if your trip is cancelled or interrupted due to covered events. These can include serious illness, injury, a death in the family, natural disasters, or other unexpected incidents.

- Baggage and Personal Effects: If your luggage or personal items are lost, stolen, or damaged, this coverage compensates you. While standard items like clothing and travel documents are usually included, there may be limits on high-value items.

- Emergency Evacuation and Repatriation: In case of a medical emergency, this covers the cost of transportation to the nearest suitable medical facility or even repatriation to India for further treatment. This is particularly important when travelling in areas with limited healthcare options.

- Personal Liability: If you accidentally cause injury to someone or damage their property during your trip, this coverage helps with legal costs and compensation.

However, there are standard exclusions. Pre-existing medical conditions are often excluded unless explicitly declared and approved. High-risk activities might require additional coverage, and incidents involving alcohol, drugs, intentional harm, illegal activities, or travel to areas under government advisories are typically not covered. Routine medical check-ups and elective treatments are also excluded.

Coverage Scenarios Comparison

Different policies handle travel scenarios in distinct ways, making it crucial to align your choice with your needs.

- For medical emergencies, international policies generally offer higher hospitalisation coverage compared to domestic ones, which can be a significant factor when dealing with expensive treatments abroad.

- Trip cancellation benefits vary, with some policies providing higher limits for single trips, while others distribute coverage across multiple trips within a year.

- In cases of baggage loss or delay, premium policies may offer immediate assistance, such as covering essential purchases during a delay, while basic policies might require proof of loss before processing reimbursement.

- The claims process also differs. Some plans provide cashless treatment at network hospitals, where the insurer settles bills directly. Others may require you to pay upfront and file for reimbursement later, which can be challenging in emergencies.

Understanding these nuances ensures you’re better prepared to select a policy that fits both routine travel needs and unexpected situations.

How to Choose the Right Policy

Selecting the right travel insurance policy isn’t just about ticking boxes - it’s about finding a plan that aligns with your destination, trip length, age, health, activities, and financial exposure. Let’s break it down step by step.

Evaluating Your Travel Requirements

Start by considering the essentials: where you’re going, how long you’ll be away, and the purpose of your trip. For international travel, especially to countries with high medical costs, it’s wise to choose a policy with generous medical coverage. On the other hand, a basic plan might work for short domestic trips.

Frequent flyers, particularly business travellers, often benefit from annual multi-trip policies. If you’re an older traveller, look for policies that cater to your needs, offering enhanced medical benefits or covering pre-existing conditions (with proper documentation). Planning an adventurous trip? Activities like trekking or skiing may not be covered under standard plans, so make sure your policy includes these high-risk activities.

Think about your travel expenses, too. If you’ve invested heavily in flights, hotels, or tours, it’s worth opting for higher trip cancellation or interruption coverage. On a tighter budget? Prioritise strong medical coverage, even if that means scaling back on other aspects.

Coverage Limits and Support Services

Coverage limits are critical, and they should reflect the costs in your chosen destination. For instance, if you’re heading to a remote area, emergency evacuation coverage is a must. Look for policies with 24/7 multilingual support, direct billing, and efficient claims processing. Cashless treatment networks can also be a lifesaver, allowing hospitals to bill the insurer directly without you needing to pay upfront.

Another factor to consider is the insurer’s reputation for handling claims. A company with a solid track record in processing travel insurance claims is likely to provide better service when it matters most.

Reading Policy Terms and Conditions

Before finalising your policy, dive into the fine print. Hidden restrictions can make or break your experience if you ever need to file a claim. Pay close attention to exclusions - these might include undeclared pre-existing conditions, injuries from high-risk sports, or incidents involving alcohol or drugs. Similarly, travel to regions under government advisories may be excluded or come with additional conditions.

Understand waiting periods, which might delay the activation of certain benefits. Sub-limits are another key area to review; for example, coverage for baggage, electronics, or jewellery may be capped at lower amounts than the total benefit. Deductibles and co-payments can also impact the amount you’ll receive after a claim, so factor these into your decision.

Lastly, check the geographic scope of your coverage. Some policies exclude specific regions or charge extra for high-cost destinations. It’s also worth reviewing terms for policy renewal and extension - having the option to extend coverage mid-trip can be a lifesaver if your plans change unexpectedly.

Niyo’s Travel Insurance Solutions

Niyo has crafted its travel insurance to meet the specific needs of Indian travellers, seamlessly integrating all essential travel finance tools into a single platform. Here’s a closer look at what makes this offering stand out.

Coverage That Fits Every Travel Purpose

Niyo’s travel insurance covers a wide range of scenarios, including medical emergencies, trip cancellations, and baggage loss. Whether you’re heading out for business, leisure, or education, the plan is designed to safeguard your travel plans. Plus, with pricing in INR, it aligns perfectly with the needs of Indian travellers.

All-in-One Travel Management

One of the standout features of Niyo’s insurance is its integration with Niyo’s broader travel services. From zero forex markup cards and international eSIMs to visa services, flight bookings, and hotel reservations, everything is accessible through the Niyo App. This integration not only simplifies managing your travel but also ensures that insurance details are linked to your bookings. In emergencies, this makes accessing critical information and processing claims much easier.

Designed Specifically for Indian Travellers

Niyo keeps things simple and transparent by pricing policies in INR, ensuring coverage limits are easy to understand. Add to this the convenience of digital claims processing and 24/7 customer support, and you have a solution that ensures help is always just a click away, no matter where you are on your journey.

Practical Tips for Indian Travellers

Staying organised with your travel insurance can save you from unnecessary stress and delays. Here’s how Indian travellers can manage their insurance documents, utilise digital tools, and navigate regional requirements effectively.

Managing Insurance Documents and Claims

Keep multiple copies of essential documents in different formats and locations. Have digital backups of your policy certificate, passport, and emergency contacts, and store physical copies securely. Emailing these documents to yourself ensures easy access across devices.

Document incidents thoroughly to support any claims. For example, take photos of damaged luggage, keep medical receipts (preferably with hospital letterheads), and obtain written reports for flight delays or cancellations. Many Indian travellers face claim rejections due to incomplete paperwork, so being meticulous from the start can save you a lot of trouble later.

Understand claim timelines for different scenarios. For medical emergencies, notify your insurer within 24-48 hours. Baggage issues often need to be reported immediately. If you’re facing significant expenses, seek pre-approval from your insurer to ensure that the costs are covered and that you’re using approved facilities.

Keep original receipts with clear details of dates, amounts (including exchange rates), and provider information. Currency conversion can be a stumbling block for Indian travellers, so track the exchange rates used and ensure receipts are complete and legible.

These steps align well with the digital features offered by the Niyo App, which can simplify your travel insurance experience.

Using Niyo’s Management Tools

Digital tools can make managing travel insurance much easier, and the Niyo App is designed to bring all your essentials together. From policy details to real-time tracking, it’s a handy companion for Indian travellers.

- Real-time spend tracking: Monitor reimbursable expenses easily. The app’s transaction history helps you keep a detailed record of your spending, which is especially useful for filing claims or identifying unusual charges.

- ATM locator: In medical emergencies or urgent situations requiring upfront payments, this feature can help you quickly find cash withdrawal points - a critical need when travelling abroad.

- Digital claims processing: Say goodbye to tedious paperwork. Upload photos of receipts and documents directly through the app, track claim status in real-time, and get updates without the hassle of repeated calls to customer service.

Regional Requirements and Health Considerations

Understanding the specific requirements of your destination is just as important as managing your documents. Here’s what Indian travellers should keep in mind:

- Schengen visa requirements: Travel insurance covering at least €30,000 (about ₹27,00,000) in medical expenses is mandatory. The policy must cover all Schengen countries and the full duration of your stay. Inadequate coverage is a common reason for visa rejections.

- Middle Eastern countries: Places like the UAE and Saudi Arabia often require proof of health insurance, especially for post-COVID travel. Some policies must include coverage for COVID-19 treatment, so double-check your policy before applying for a visa.

- High-altitude activities: If you’re visiting Nepal, Tibet, or high-altitude regions in Europe, make sure your policy covers altitude sickness. Standard travel insurance usually excludes activities above 3,000-4,000 metres or adventure sports, so additional coverage might be necessary.

- Pre-existing conditions: If you have diabetes, hypertension, or other ongoing health issues, declare them when purchasing insurance. Many policies offer coverage for pre-existing conditions at a higher premium, which can be worth the extra cost.

- Monsoon season travel: Travelling within India or to Southeast Asia during monsoon months (June to September) can bring weather-related disruptions. Opt for policies that cover natural disasters and trip cancellations due to heavy rains or cyclones.

- Vaccination requirements: Some destinations require proof of specific vaccinations, and failing to meet these requirements can affect your insurance coverage. Policies may exclude treatment for preventable diseases, so ensure you’re up to date on recommended vaccines.

Conclusion

Travel insurance isn’t just an optional add-on. It’s your financial safety net when things go off track. From medical emergencies and lost luggage to unexpected flight cancellations, having the right policy can save you from spending lakhs of rupees unexpectedly.

Picking the right policy is all about matching it to your travel style. Whether you’re a business traveller, adventurer, or heading out with family, each journey comes with its own risks. Understanding these differences and carefully reviewing the fine print ensures you’re not caught off guard when it’s time to make a claim.

Niyo offers a seamless solution for Indian travellers by integrating travel insurance with its services. With everything - policy details, transaction history, and claims - accessible in one app, you no longer have to juggle between platforms during emergencies. This kind of convenience ensures that help is always just a tap away when you need it most.

Being prepared is key. Keep your documents handy, know your policy limits, and have your insurer’s contact details ready, no matter where you are. A little effort now can save you from major financial headaches later.

With the right coverage and preparation, you can travel with peace of mind, knowing you’re shielded from unexpected expenses.

Frequently Asked Questions

Choosing between single-trip and multi-trip travel insurance boils down to how often you travel. If you’re planning just one trip in the year, single-trip insurance is tailored to cover that specific journey. However, if you’re a frequent traveller, multi-trip insurance can save you money by covering multiple trips within a year under a single policy.

Another factor to keep in mind is the length of each trip. Many policies set limits on the maximum duration per trip - common options include 30, 45, or even 180 days. Think about your travel habits and how often you’re on the move. This way, you can pick a plan that provides the right coverage without stretching your budget unnecessarily.

To make sure your travel insurance covers adventure sports or high-risk activities, you’ll need to find a policy that specifically includes them. Most standard travel insurance plans don’t cover these activities, so you might have to go for a specialised add-on or a policy designed for adventure enthusiasts.

When selecting a policy, double-check that it includes the exact activities you’re planning - whether it’s trekking, scuba diving, skiing, or something else. Ensure the medical coverage is adequate to handle potential injuries, and verify that the coverage limits align with your requirements. Carefully go through the policy terms to avoid any unexpected issues, and don’t hesitate to reach out to the insurer if anything is unclear.

To ensure a hassle-free claims process with Niyo’s travel insurance, the first step is to notify the insurer as soon as the incident occurs. Gather all the essential documents, such as medical reports, police reports, invoices, and receipts that support your claim.

Next, complete the claim form with accurate details and attach all the required documents. It’s a good idea to keep copies of everything you submit for your own records. Maintain regular communication with the claims team and follow up periodically to stay updated on the progress. Staying organised and acting quickly can make the entire process smoother and quicker.