Ultimate Benefits of Domestic Lounge Access Credit Cards in India

Lounge access can elevate your airport experience with comfort and perks. The Niyo app’s Travel Mode helps you get the most out of every trip.

What are Domestic Lounge Access Credit Cards?

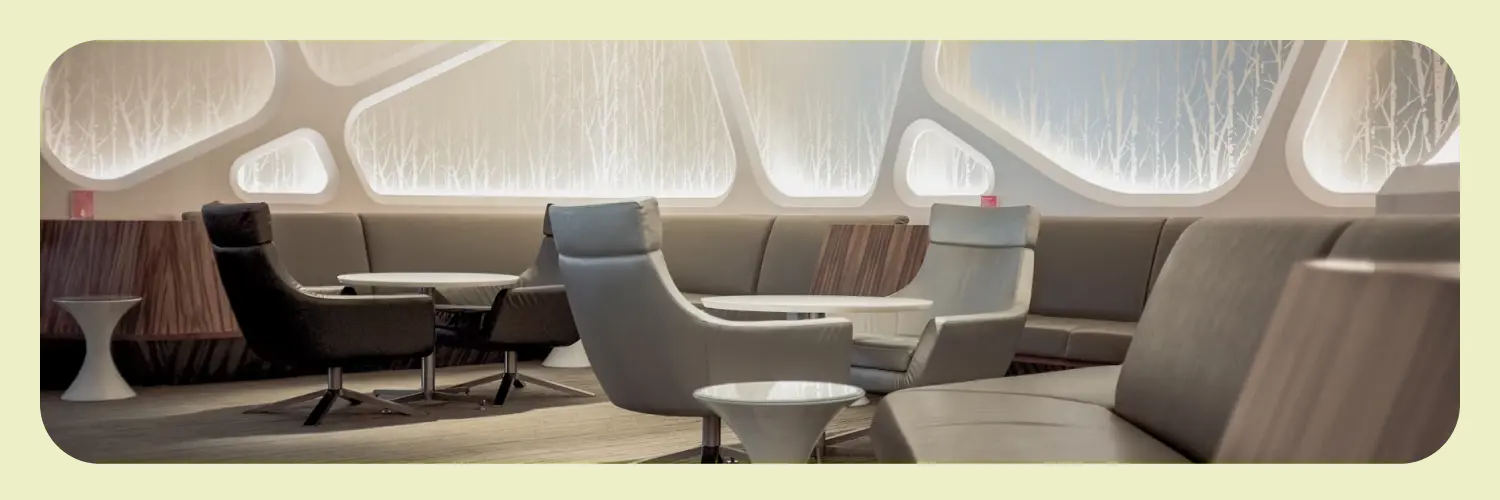

If you’re unfamiliar with domestic lounge access credit cards, let’s start with the basics. These cards offer complimentary access to airport lounges within India. With these cards in hand, you can enjoy a range of amenities such as comfortable seating, refreshments, and even shower facilities. No more scrambling for seats or enduring crowded waiting areas – lounge access provides a peaceful oasis amidst the chaos of air travel.

How Does Domestic Lounge Access Work?

Now that you understand what domestic lounge access credit cards offer, let’s delve into how it works. Most credit cards with lounge access privileges require you to enroll in a program or join a specific network. These programs provide access to a network of lounges across various airports in India.

Some may have partnerships with specific airlines or lounge networks, so it’s important to choose a card that aligns with your travel preferences. Keep in mind that in most cases, you need to have a spend-based credit card if you wish to access domestic lounges.

Benefits of Domestic Lounge Access Credit Cards

Owning a domestic lounge access credit card comes with a host of benefits that can greatly enhance your travel experience. Let’s take a look at some key advantages you can gain from cards

- Complimentary Access: The primary benefit of these cards is the complimentary access they provide to airport lounges. This perk alone can make your travel experience more comfortable and enjoyable.

- Relaxation and Comfort: Lounges offer a peaceful environment where you can unwind before or between flights. Enjoy comfortable seating, quiet spaces, and amenities like showers and nap rooms to recharge during layovers.

- Productivity: Lounges are equipped with facilities like Wi-Fi, charging stations, and workspaces, allowing you to catch up on work or stay connected with friends and family while waiting for your flight.

- Priority Services: Some credit cards offer additional perks such as priority check-in, fast-track security clearance, and priority boarding. These privileges can save you time and make the airport experience more efficient.

Different Types of Domestic Lounge Access Credit Cards

When it comes to domestic lounge access credit cards, not all cards are created equal. Let’s explore the different types of cards available in the market:

- Co-branded Credit Cards: These cards are issued in partnership with specific airlines or lounge networks, offering lounge access as one of the primary benefits.

- Premium Travel Credit Cards: Some premium travel credit cards come with complimentary lounge access privileges as part of their extensive travel benefits package.

- Standalone Lounge Access Credit Cards: There are also standalone credit cards that focus solely on providing lounge access across various airports.

How to Choose the Right Domestic Lounge Access Credit Card

With numerous options available, choosing the right domestic lounge access credit card can be overwhelming. Here are some factors to consider:

- Coverage: Check the network of lounges covered by the card and ensure they align with your preferred travel destinations and airlines.

- Cost vs. Benefits: Evaluate the annual fee, interest rates, and other charges associated with the card against the benefits it offers. Look for cards that offer a good balance between costs and privileges.

- Additional Benefits: Explore other perks offered by the card, such as travel insurance, reward programs, concierge services, and exclusive discounts on flights or hotel bookings.

- Customer Support: Research the reputation of the credit card issuer in terms of customer service and reliability.

How to Make the Most of Your Domestic Lounge Access Credit Card

Now that you’ve chosen the perfect domestic lounge access credit card, here are some tips to maximise its benefits:

- Plan Ahead: Familiarise yourself with the locations and amenities of the lounges covered by your card before your trip. This way, you can strategically plan your layovers and make the most of your time at each airport.

- Stay Updated: Keep track of any changes in lounge policies or network coverage to ensure a smooth travel experience.

- Invite a Guest: Some credit cards allow you to bring a guest into the lounge with you. Take advantage of this benefit to share comfort and relaxation with a travel companion.

- Utilise Travel Mode in the Niyo App: If you have a Niyo card, make sure to use the Travel Mode in the Niyo app to access a wide range of additional travel services, including visa application processing and international money transfers.

Key Takeaways

- Domestic lounge access credit cards provide you with a comfortable and enjoyable travel experience.

- Consider factors such as coverage, cost vs. benefits, additional perks, and customer support when choosing the right card for you.

- Maximise the benefits of your credit card by planning ahead, staying updated, inviting a guest, and utilising the Niyo app’s Travel Mode.

Owning a domestic lounge access credit card can significantly enhance your travel experiences. The comfort and convenience these cards offer can make your journeys more enjoyable and stress-free. By choosing the right card and utilising its benefits effectively, you can make the most of your time at airports and take full advantage of the amenities provided.