Live

Transfer money from

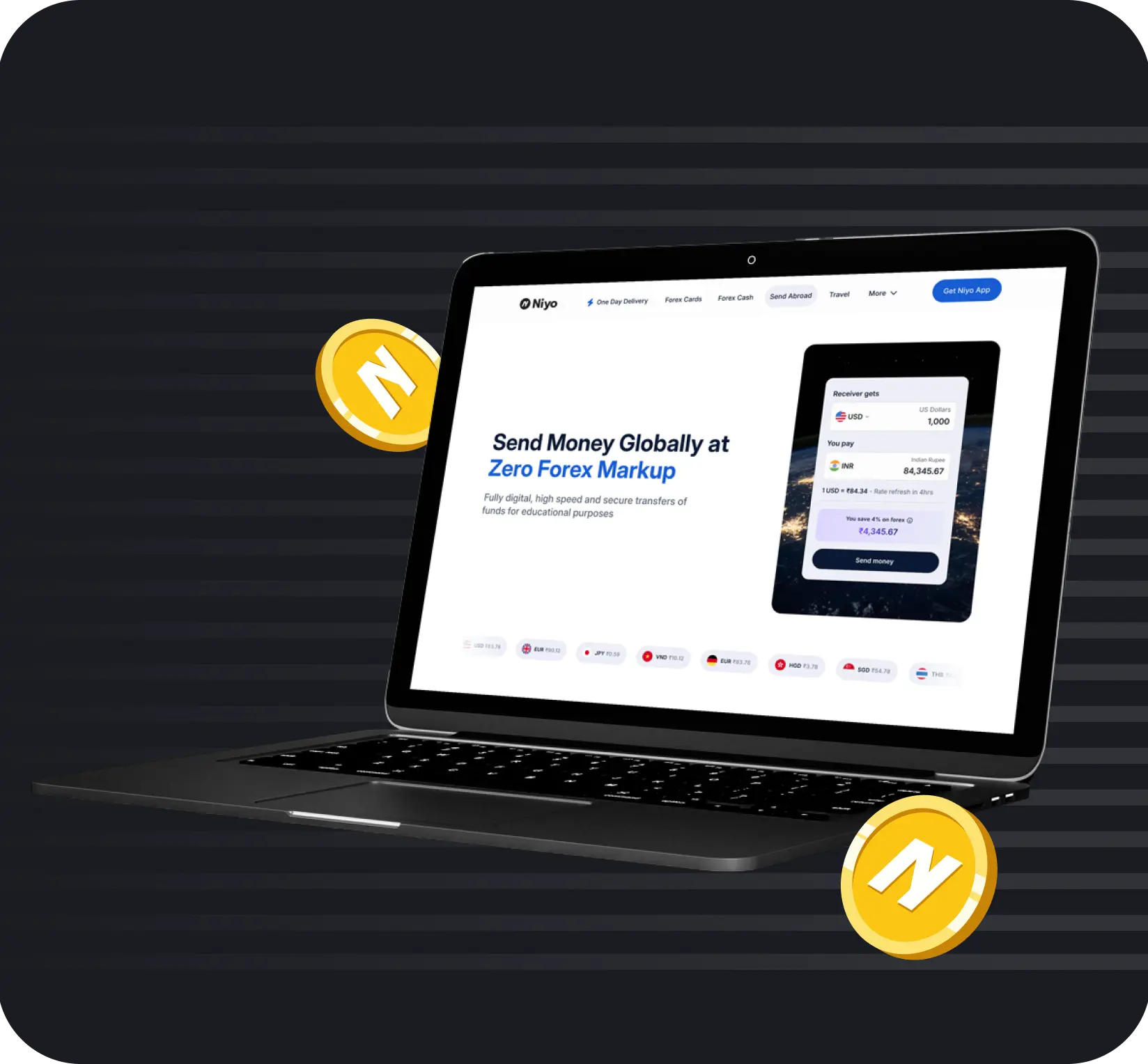

Lowest Prices: Send Money Abroad at the lowest rates

Zero fees & hidden charges: No platform fee or service charge

End‑to‑end digital tracking: Monitor your transfer status anytime via website

Fully regulated & secure, backed by RBI‑compliant partners

Need help with your transfer?

Compare fees of transferring money from India to UK

Know exactly what you’re paying - no hidden fees, no surprises. Just ZERO-cost, transparent transfers to the UK.

GBP

GBP

United Kingdom GBP

INR

INRIndian Rupee

87,705Wise

Others

Net payable

Loading...

Loading...

Loading...

Total charges

Loading...

Including Markup & SWIFT Fee

Loading...

Loading...

You pay

Total Charges

₹1,300

Wise

You pay

Total Charges

Loading...

Others

You pay

Total Charges

Loading...

Values are based on assumptions and public data; refer to the official website for the latest figures.

How to transfer money from India to UK at lowest rates

You need to use International Wire Transfer, also known as a SWIFT transfer, which falls under the RBI’s LRS. Use Niyo to complete this transfer at Zero fee-

1

Go to Niyo website

Tap 'Send Money Abroad'

2

Choose currency

Choose the currency GBP, and enter the amount you want to send

3

Add bank details

Add your recipient’s UK bank account details (university, student self, or rental property)

4

Choose payment

Pay via UPI, NEFT, etc.

5

Review & track

Review, confirm, and track your transfer in real time

Lowest Prices, Zero Fees - Maximum Savings

Fast & easy international money transfers for INR to GBP | No hidden charges | Live IBR rates for Pound to INR

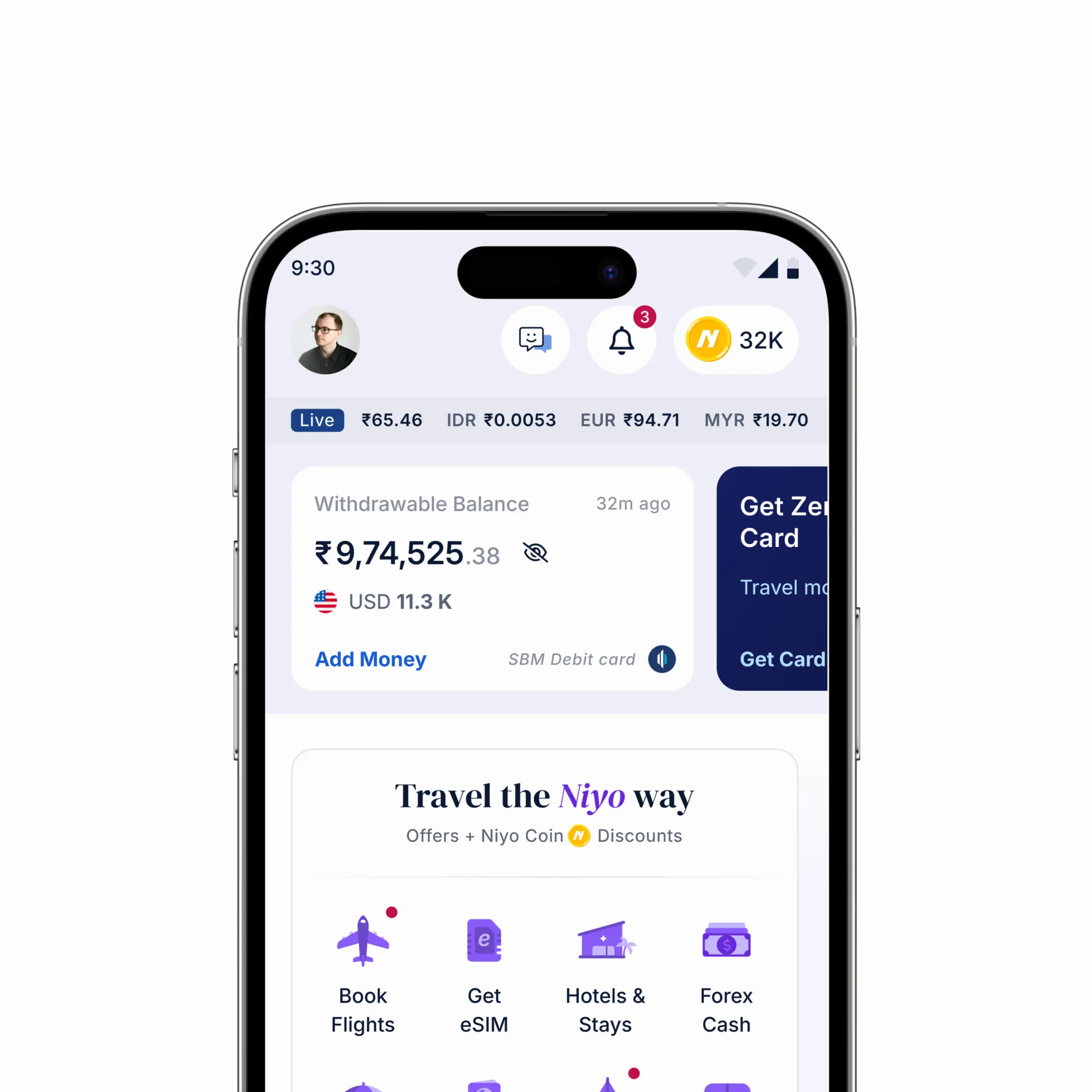

Why send money to UK with Niyo?

Niyo provides lowest prices & zero fees with RBI-compliant transfers under Liberalised Remittance Scheme

1.5% cheaper* than Wise, Flywire and others (save ~ ₹15K on transfers of ₹10L+)

Track every transfer in real time

Bank-grade encryption keeps your money & data safe

Best way to transfer money from India to UK at cheapest rates

Send money to UK right from your home with Niyo

Enjoy zero fee & lowest rateswith no hidden costs

100% digital, SWIFT transfer with RBI compliance

Instant alerts to track your transfer status in real time

One platform, full control from payment to credit confirmation

Who can do International Money Transfers to UK with Niyo?

Students, parents, grandparents, and siblings can send money abroad for tuition fees, living expenses, rent, and more—all fully RBI-compliant under LRS.

Where you can send money

To the student's UK account

Directly to the university for tuition fees

To rental property owner for accommodation

Other approved education-related expenses

Here's what our users say

Powered by

A/3, Gokul Arcade CHS Ltd., Sahar Road, Vile Parle (East), Mumbai - 400057, Maharashtra (IN)

FAQs

If you’re looking to transfer money from India to the UK, Niyo makes it seamless with a 100% digital process. Just visit the Niyo website, enter the recipient’s UK bank details, upload your KYC documents, and initiate the transfer. You can track your transfer to the UK in real time. No physical paperwork or bank visits are required.

The best way to send money from India to the UK is through a digital remittance platform like Niyo. You get transparent charges, lowest fees, and complete control from your phone. Compared to traditional bank methods, Niyo offers a faster, more innovative, and cost-effective solution for sending money to the UK

Niyo money transfers to the UK typically take 2–3 working days, depending on the receiving bank’s processing time. Once you send money to the UK from India, you can monitor its journey through the Niyo website, ensuring peace of mind from start to finish.

As per the RBI’s Liberalised Remittance Scheme (LRS), you can send up to USD 250,000 per financial year from India to countries like the UK, etc. Niyo ensures that all transfers are LRS-compliant and guides you through the process to help you send money to the UK smoothly.

Absolutely. Niyo allows you to send money to the UK from India through its website. Whether you’re paying tuition, covering rent, or sending money to cover expenses like groceries, travel, etc., the process is completely digital, compliant with regulations, and built for your convenience.

To send money from India to the UK via Niyo, you’ll need a valid PAN card, Aadhaar, or passport, along with documents that support the reason for the transfer (e.g., an admission letter, invoice, or rent agreement). Niyo’s in-app document upload feature makes it easy and hassle-free.

Yes, it’s highly secure. When you transfer money from India to the UK using Niyo, your data and funds are protected with 2-factor authentication, encrypted technology, and regulated banking channels. All transfers follow RBI guidelines under the Liberalised Remittance Scheme (LRS).

There are no hidden fees. When you send money to the UK through Niyo, you’ll get complete transparency, see the exact charges and exchange rate before you hit confirm. Plus, there is no platform fee or service charge

Top currencies we support

* Terms & Conditions Apply

About Niyo

Founded in 2015, Niyo has spent the last 10 years building secure, transparent, and innovative financial solutions - serving over 15 lakh customers across 25+ Indian cities.

RBI regulated & licensed: Owns Kanji Forex, a 90-year-old RBI-approved AD-II license holder for secure and legal international money transfers.

Safe & compliant banking: Partnered with regulated Indian banks like IDFC FIRST, YES Bank, and DCB for trustworthy money handling.