Neo-Banking A differentiated, simplified, holistic banking experience

Neo-banking vs Traditional Banking

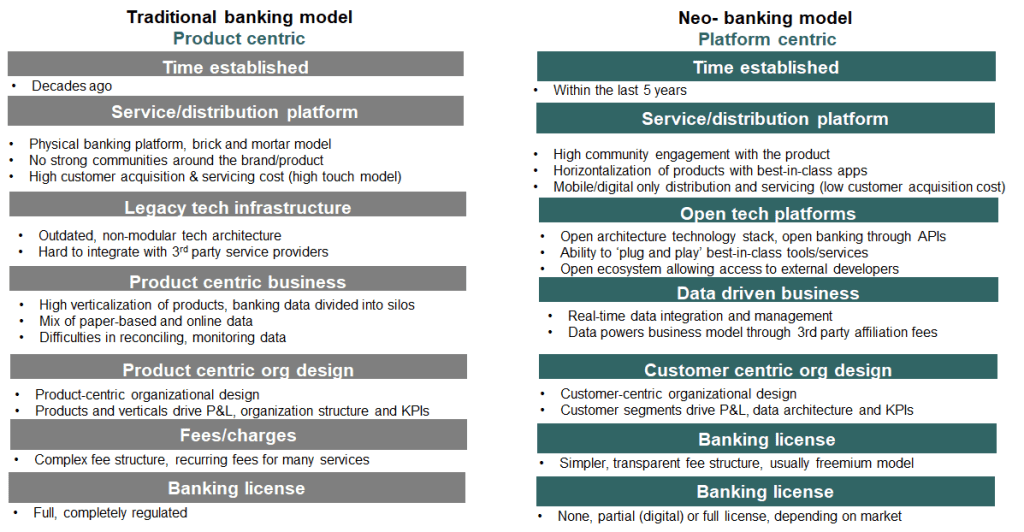

Over the past few decades, traditional banks have established themselves by dividing their business functions into siloed departments. Consequently, their systems, processes, and culture all function as distinct entities. Traditional banks also rely heavily on a “physical touch model”, meaning feet-on-street sales forces, branches, and other physical distribution channels play a key role in their day-to-day business operations. Neo-banks, on the other hand, have modelled their business on scalable open platforms, similar to Airbnb or Netflix.

To a large extent, neo-banks are technology platforms that integrate with traditional banks through open APIs. This makes them inherently scalable, nimble, and flexible.

Advantages of Neo-banks over Traditional Banks

Neo-banks are completely digital. This means that they have both lower fixed-cost structures, and flexible, scalable systems and processes. These factors bring many inherent advantages to neo-banking models over traditional banking models.

Hassle-free account operation:

When everything is digital, there is no need to stand in a long queue at a bank branch or fill out extensive paperwork. A neo-banking account can be opened through a paperless, presenceless, digital process that takes less than 5 minutes to complete. What’s more, you can do it on your own smartphone.

A different class of UI/UX:

Neo-banks are all about providing an excellent, seamless customer experience. This means you don’t have to work through a glitchy netbanking site which is difficult to navigate. Neo-banks offer crisp, well detailed, highly responsive mobile apps innovative features such as fingerprint locking/facial recognition, the ability to hide or show your account balance through hand gestures, swiping up/down/right/left for different functionalities, etc.

Other features:

Neo-banks have pioneered the concept of paying seamlessly in any currency for cross-border transactions. These transactions are free of forex mark-ups or any other charges. Neo-banks also offer many innovative tools for safety and security, which are critical when spending abroad, especially in unfamiliar destinations.

As neo-banks are becoming more established, different aspects of personal finances are also becoming a part of their offerings. Neo-banks around the world are experimenting with finance trackers, investment opportunities, and many more innovative personal finance tools.

Value-added tools:

Along with banking products and services, neo-banks also offer a host of innovative tools for both ease and utility. These include ATM locators, bill splitters, monthly budget creators and trackers, and much more.

In a nutshell, neo-banking is much more than just a cool mobile interface on top of a traditional bank account. While digital banking (or mobile banking) has been prevalent for at least the last decade or so, neo-banks bring much more to the table. With a differentiated and simplified, yet holistic banking experience, and features that help users build intuition and take charge of their personal finances, neo-banks are changing the way we think about banking. Banking truly can be accessible and user-friendly, and soon, it will be.